Table Of Content

- Special Circumstances Savings on Real Estate Taxes

- What if my home sells at a loss?

- Can You Save on Your Real Estate Taxes?

- TURBOTAX ONLINE/MOBILE:

- Short-Term Capital Gains Tax: Explained

- Sales and property tax refund program for senior citizens and citizens with disabilities

- Let a tax expert do your taxes for you

It’s possible to exchange your business property for another person’s business property and defer the tax liability, Levine noted. But the same isn’t true of residential buildings unless they are rental units. The rules for the usual home sale transaction, a “straight” sale, are fairly straightforward, and most of the time a straight sale does not trigger taxes.

Special Circumstances Savings on Real Estate Taxes

Vt. bill aims to ease tax abatement and sale policies for delinquent property owners - WCAX

Vt. bill aims to ease tax abatement and sale policies for delinquent property owners.

Posted: Thu, 15 Feb 2024 08:00:00 GMT [source]

As mentioned, there are several exceptions to IRS home sale exclusion rules. For example, if you are transferring a home to a spouse or ex-spouse the IRS doesn’t consider that to be a gain or a loss. You can use Schedule LEP (Form 1040), Request for Change in Language Preference, to state a preference to receive notices, letters, or other written communications from the IRS in an alternative language. You may not immediately receive written communications in the requested language. The IRS’s commitment to LEP taxpayers is part of a multi-year timeline that began providing translations in 2023. You will continue to receive communications, including notices and letters, in English until they are translated to your preferred language.

What if my home sells at a loss?

There is no tax deduction for transfer taxes, stamp taxes, or other taxes, fees, and charges you paid when you sold your home. However, if you paid these amounts as the seller, you can treat these taxes and fees as selling expenses. If you pay these amounts as the buyer, include them in your cost basis of the property. Cartier owned and used a house as a main home from 2015 through 2018.

Can You Save on Your Real Estate Taxes?

So to get a complete tax picture, contact the tax department of the state where you own the property. Stacey creates three copies of Worksheet 2 and titles them “Business or Rental,”“Home,” and “Total” to allocate basis and the amount realized for the different uses of the property. If you received your home as a gift, you should keep records of the date you received it. Record the adjusted basis of the donor at the time of the gift and the fair market value of the home at the time of the gift. As a general rule, you will use the donor’s adjusted basis at the time of the gift as your basis.

If you owned the home for at least 24 months (2 years) out of the last 5 years leading up to the date of sale (date of the closing), you meet the ownership requirement. For a married couple filing jointly, only one spouse has to meet the ownership requirement. The result of all these calculations is the adjusted basis that you will subtract from the selling price to determine your gain or loss. This adjusted basis is what's considered to be your cost of the home for tax purposes. In most, but not all situations, the profits you make upon the profitable sale of an asset are taxable.

State senator says sales tax increase is necessary to lower property taxes by 40% • Nebraska Examiner - Nebraska Examiner

State senator says sales tax increase is necessary to lower property taxes by 40% • Nebraska Examiner.

Posted: Wed, 17 Jan 2024 08:00:00 GMT [source]

For this rule to apply, at least half the value of the community property interest must be includible in the decedent's gross estate, whether or not the estate must file a return. If you used part of your home for business or rental purposes, see Foreclosures and Repossessions in chapter 1 of Pub. When you trade your home for a new one, you are treated as having sold your home and purchased a new one. Your sale price is the trade-in value you received for your home plus any mortgage or other debt that the person taking your home as a trade-in assumed (took over) from you as part of the deal.

You can meet the requirements for a partial exclusion if the main reason for your home sale was a change in workplace location, a health issue, or an unforeseeable event. The offers that appear on this site are from companies that compensate us. But this compensation does not influence the information we publish, or the reviews that you see on this site.

If you received Form 1099-S, Proceeds From Real Estate Transactions, the date of sale appears in box 1. If you didn’t receive Form 1099-S, the date of sale is either the date the title transferred or the date the economic burdens and benefits of ownership shifted to the buyer, whichever date is earlier. Generally, if you transferred your home (or share of a jointly owned home) to a spouse or ex-spouse as part of a divorce settlement, you are considered to have no gain or loss. You have nothing to report from the transfer and this entire publication doesn’t apply to you. However, if your spouse or ex-spouse is a nonresident alien, then you likely will have a gain or loss from the transfer and the tests in this publication apply. To qualify as your primary residence, the IRS requires that you prove the property was your main home where you lived most of the time.

Let a tax expert do your taxes for you

Critics, especially those in psychedelic advocacy circles, argued the bill would infringe upon individuals’ right to free speech. The committee postponed consideration of the bill indefinitely. Meanwhile, three land-use reform bills — covering minimum parking requirements, accessory-dwelling units and density near transit — are all hung up in the Senate, awaiting various votes.

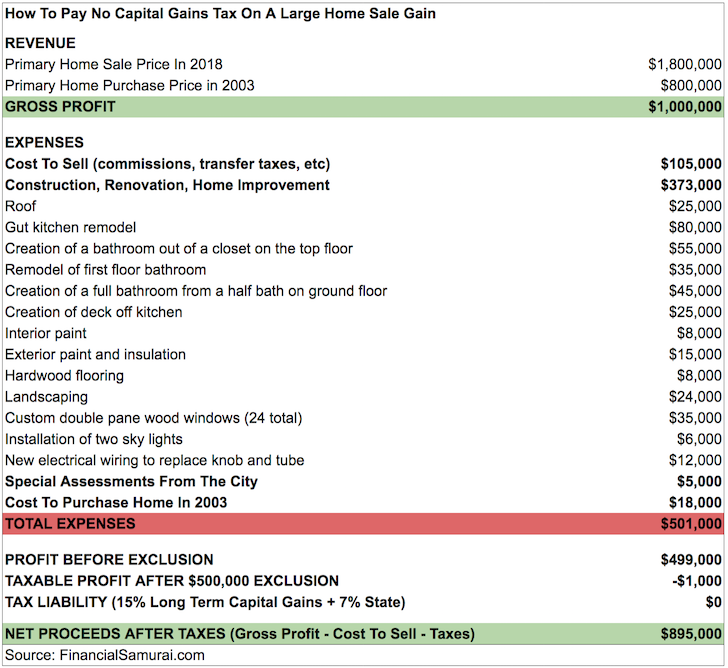

If you meet a few simple requirements, up to $250,000 of profit on the sale of your home is tax-free. If you don’t owe taxes, you don’t even need to list your home sale on your tax return. From personal items to investment products, almost all of your possessions are capital assets. That includes property like cars or real estate and investments like stocks or bonds. Let’s say you decide to sell one of these assets, such as your home. The profit you make from the sale can potentially incur a tax called a capital gains tax.

This section contains step-by-step instructions for figuring out how much of your gain is taxable. See Worksheet 3, later, for assistance in determining your taxable gain. Special rules for capital gains invested in Qualified Opportunity Funds. Once you live in that home for two years, you have been able to exclude up to $500,000 of profit again.

No comments:

Post a Comment